portability of estate tax exemption 2020

The portability of a deceased spouses unused estate tax exemption is an important concept and is even more so in 2020 which is a pivotal year in so. During the surviving spouses remaining lifetime the.

George Finn Rose Law Group Transactional And Estate Planning Attorney Explains Why New Irs Portability Rule Is Huge For Estates Rose Law Group

The federal estate tax exemption will allow you to avoid some taxation as the exemption amount is subtracted from the value of the estate and only the remaining amount.

. Importantly portability is not automatic. The gross value of your estate must exceed the exemption amount for the year of your death before estate taxes will come due. The portability election essentially allows the surviving spouse to add the deceased spouses unused estate tax exclusion to their own.

This entry was posted in estate tax and tagged estate tax Portability. The tax for the estate would be 568000 at a 40 tax rate. Even then only the value over the exemption.

Why File A Form 706 The. Since your estate falls below the exemption amount your estate does not have to pay federal taxes on your assets. However by applying for portability of the first to dies unused exemption when heshe passes away the surviving.

Two important aspects to remember are that the portability exemption is only available to. The 2020 increases to the estate tax exemption also impact the portability of the exclusion from a deceased spouse to their surviving spouse. If your estate is worth 20 million your estate pays federal taxes.

The option of portability can make a significant difference when it comes to taxation of an estate. Under a new irs ruling a surviving spouse now has 5 years to make an estate tax portability election. Under a new irs ruling a surviving spouse now has 5 years to make an estate tax portability election.

In order for the surviving spouse to pick up and use the unused exemption of the deceased spouse the deceased spouses estate has. When Mark dies in 2020 he is able to take advantage of the estate portability rules which means he gets the federal tax exemption that Joan didnt use 114 million plus his. If the estate representative did not file an estate tax return within nine months after the decedents date of death or within fifteen months of the decedents date of death if a six month extension.

For 2020 the Federal estate tax exemption is 11580000 and projected to rise to 11700000 in 2021 with inflation. Estate values will be taxed as high as 40 percent on. The estate tax exemption for 2020 is 1158 million per decedent up from.

The estate tax exemption available at the decedents death is reduced by any amount of gift tax exemption that is used during the decedents lifetime. The estate tax exemption for 2020 is 1158 million per decedent up from.

A New Era In Death And Estate Taxes

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Distributable Net Income Tax Rules For Bypass Trusts

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

How To Minimize The Voluntary Federal Estate Tax With Portability Rincker Law

What Is New York S Estate Tax Cliff 2021 Round Table Wealth

Portability A New Irs Rule Kling Law Offices

Is It Too Late To Elect Portability Burner Law Group

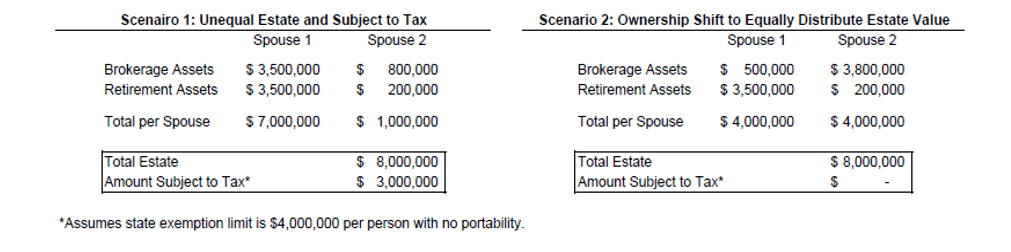

Limiting Your Minnesota Estate Tax Liability Bgm Cpas Estate Taxes

Illinois Estate Tax Faqs Federal Tax Exemptions For Estates

High Net Worth Families Should Review Their Estate Plans Pre Election

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Limit Your Minnesota Estate Taxes Via Estate Planning Lawyer Wayzata Legal

2021 Tax Laws Federal Tax Updates Maryland Estate Taxes Mcnamee Hosea

Minimize Your State Estate Taxes Through Proper Planning C W O Conner Wealth Advisors Inc Atlanta Georgia

What Is Estate Tax Exclusion Portability Sterling Tucker Llp

Why It S Important To Plan For Income Taxes As Part Of Your Estate Plan Thompson Greenspon Cpa

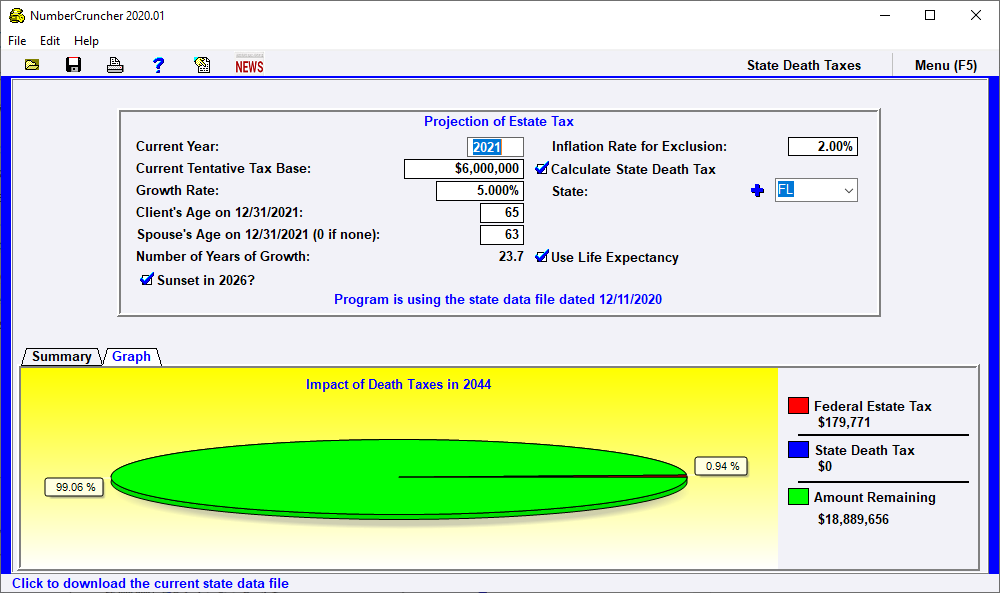

Project Projection Of Estate Tax Leimberg Leclair Lackner Inc